How to Manage your Money Abroad

I had been striking out all day with language failures. I couldn’t order a vegetarian burger (I ate plain white rice instead), we waited twenty minutes for a bus (maybe we could have taken the one right in front of us), and by this point I was standing at the ATM armed with my Spanish/English dictionary. The world must have been looking down on me with pity because as I inserted my card I got a prompt in English (that didn’t happen at the last ATM), “Please enter your PIN,” followed by, “Please select your language.” It felt like I had just won a mini lottery.

Traveling abroad can be intimidating enough for people. Trying to figure out monies, manage bank accounts long distance and learn the local currency doesn’t always help build confidence. With the right planning and preparation, handling you money abroad can be no more difficult than enjoying a cup of coffee at a cafe with wifi and checking on your accounts.

If you are planning a trip abroad and looking for some tips on what to do, here’s how we manage our money while traveling:

Get a couple cards:

- In case a card gets damaged and the slider part stops reading, you have a back up.

- You can stash your other cards in different locations in your stuff.

- If you need to compare cards, credit card insider has a handy comparing tool.

- You will have access to more money or credit in case you need it for an unseen reason.

- In case you are paying for something big, you can get money out of the ATM with multiple cards. Most ATM cards have a limit of around $500 a day. If you are buying a car or paying for an expensive activity, it can take a couple of days to be able to withdraw enough money to pay.

Carry both Mastercard and Visa

- There were some places we were in South America where ATM’s only accepted Mastercard, which is unusual. Typically Visa is accepted everywhere, so it is nice to have both just in case. I’ve never used Discover abroad, but I do get the highest reward points when buying gas for my car in the states.

Travelers checks are a thing of the past. When we first started traveling abroad, we used to bring a good amount of money over in travelers checks, somewhere in the $1000-2000 range. Our last time trying to deal with travelers checks was in 2012 when we left Australia and went to Vanuatu. Finding a place to cash them was difficult and we got a lower rate. If it makes you feel better to carry $100 or $500 traveler check hidden somewhere in your stuff, fine. Cash it back into your bank when you get home.

Avoid ATM fees:

- Get a Charles Swabb debit card. They reimburse you all your atm fees. Amazing. (Confession: before our last trip we did not get this card and we were so regretful. We paid way more in ATM fees than we thought we would. I have heard from so many other travelers about how great this card it. We are getting this card before our next trip. Sometimes slacking in an area once is the surest way to ensure you don’t repeat the same mistake twice.)

- From my hometown credit union, I have another debit card that if I need to use it, the charge is only $1. What a deal – way better than most of the big banks.

- When you are making withdrawals, take out the maximum amount of money you can (unless you have a good reason not to do this). In doing so, you will have given yourself the longest possible time before needing to get money out again and have any potential fees.

Before you go:

- I make sure I can log into any accounts I will have even the slightest chance of needing to access online. Some accounts I hardly ever log into and sometimes they might have changed a security setting and I need to call or receive a text. I double check that all my accounts are in order and I am set up to receive any important notices via email.

- I make strong passwords and change them often.

- Call all your credit/debit cards and let them know you will be out of country. With the increase of fraud this is particularly important to do.

- TIP: on our last trip in March 2014, my credit card failed to read with one swipe while buying gas. I didn’t think anything about it. Luckily for me I was coming back to the states in about two weeks time. When I opened my mail I had a brand new card (with different numbers) issued to me. I called my credit card company and asked why. They referenced the failed swipe and said that was enough to trigger their anti fraud department to issue new cards are a precautionary measure. My old card was going to be cut off in two days. So the lesson is: If you have a failed swipe, take advantage of the international toll free numbers and call your credit card company to let them know it was you. If I had still been abroad, finding out my reissued cards were sitting at my parents in America would have been stressful and time consuming waiting for new cards to be mailed to me.

Preparing for Emergencies or Worst Case Scenario:

- I make a list of phone numbers, both domestic and international, for all our credit cards and accounts that I would need to call if our wallets got stolen, lost or comprised. I email this to myself and members of my family. (Note: I do not write down my credit card numbers, just a list of phone numbers either myself or someone else can call and cancel or put a hold on the cards.)

- Also we give our emergency contacts back home a folder with copies of our birth certificates, marriage license, copy of of health insurance, drivers license, social security cards, passports.

- Always keep some emergency money stashed some where. $50-100 is a good amount. Travelers have all sorts of secret hiding spots: sew in behind patches, in empty chap stick containers or hidden in part of your back pack. The biggest thing is to make sure it’s somewhere you won’t forget about it!

Tip and Tricks:

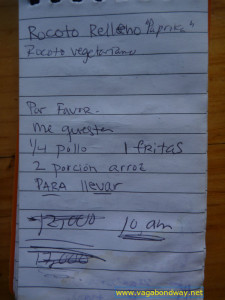

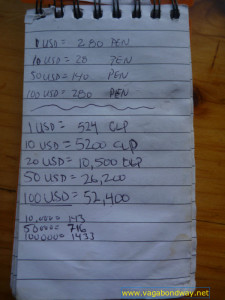

- Before we enter a new country and try to remember all the currency conversions, I use my travelers notebook and make a cheat sheet for quick reference of what I am paying for items.

- I keep a small note book on hand at all times. Many times if I can’t understand someone or they can’t understand me, I can at write “Bus 1:00?” and they can shake their head yes or no.

- I break down how much $1, 10, 20, 50 and $100 is in local currency.

- Always try to carry small denominations and break bills in grocery stores and other establishments that can give you change.

- Always budget more money than you think you will need. A lot of times we end up at destinations we may only visit once in our life. It would be shame to have to pass up on something you will regret not doing. To avoid this, plan your trip: destination, duration and activities. By picking a place you can afford to go to and do the things you want to do, you will have such a better time. Conversely if you go to a random destination only to get there and realize everything is so much more than you thought, you will be miserable looking at all things you wish you could do, but can’t afford. Plan a trip to match you current budget and mental space. You will be thanking yourself.

- Check out www.xe.com to see what the rates are changing at.

Know your Goals ahead of time:

- The more you travel, the more you realize how big the world and how many activities and areas there are to experience. Having an idea of your objectives before you head out will help you stay focused on spending money towards the things you want.

Our goals are to save money so we can travel more. If giving Chris a hair cut in the evening twilight helps us achieve that goal, bring on the scissors!

- For instance, if your passion or interest is to track down anything related to the music about a place, realize that. Research and find good deals on shows or look for coupons to museums. If you’re not careful, you’ll end up seeing the million and one advertisements saying you have not seen xyz city/place until you’ve gone a duck tour, ate at this restaurant, bungee jumped this once in a life time bridge, ect. Next thing you know you’ve blown all your money on a duck tour when what you wanted was to see music.

Traveling abroad has got to be about one of the coolest things we can do. With some planning and preparation, hopefully you will be able to afford to travel abroad many times to come. Traveling is a skill, and like any learned skill, the more you do it, the better you become at it. Put yourself in a situation where your first time abroad can be fun and handle a few screw ups. Look to those around you with more experience. Most travelers are team players and more than happy to share what they know with you. With a bit of practice, you’ll be navigating your world of finance with ease from any where on the planet.

Previous Post

Previous Post Next Post

Next Post

Nice! Lots of sound advice for managing your pocket book when travelling. Works well for in the USA too!

Yes, definitely for the USA. If you live in the states, definitely make sure you have a credit card that you earn rewards of some sort on. I always try to pay cash at small businesses, otherwise I make sure every transaction I am spending money on, I am also making money on.

Great travelers tips including a couple unforeseen situations. I love the last pic at the airport with Chris giving a “peace” sign, a universal sign of friendship and Tiffany doing Jazz Hands, a universal sign of I Got Rhythm.

I do love my jazz hands. And I love our airport pics. It’s one of my favorite things to do is take pics of us coming or going from airports.

Nice tips… Very informative and a bit into different things you sacrifice to travel. There was a lot of information in this post that I never would think of.

Thanks, like I said, travel is a skill and the more you do, the better you will become. These are just a small sampling of tricks from our ten years of travel. There are so many areas we are still trying to improve on for ourselves still!

My brother recommended I may like this website. He used to be

totally right. This submit actually made my day. You can not imagine simply how much time I had spent for this info!

Thanks!